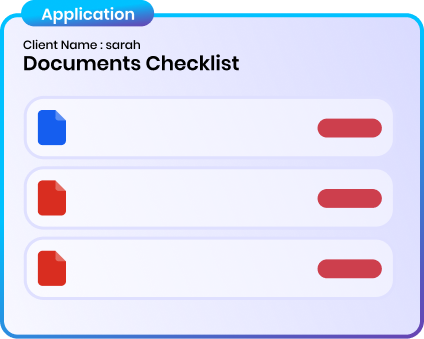

- Borrower portal enables direct uploads with instant checklist alerts.

- Gentle email and SMS reminders will keep borrowers on track.

- Leverages Google Drive, OneDrive, Zapier, and Dropbox to streamline data flow.

SBA loans can bury you in forms, compliance headaches, and slow-moving borrowers. DocsNow gives SBA and CDC lenders a secure document collection software that speeds up loan applications and delivers a smoother borrower experience.

Book a Demo

Express loan processing up to 80% with automated document collection and E-Tran-ready workflows.

Saves hours daily with smart checklists and CRM-integrated workflows.

A simple, secure upload experience that keeps clients satisfied.

Eliminate email clutter and follow-ups with clear checklists and automated uploads, allowing you to focus on closing loans efficiently.

Streamline SBA forms (e.g., Form 1919) into fillable forms for accuracy. It removes the need for physical forms and manual entries.

Facilitate data transfer and auto-map information for 7(a) and 504 loans, with real-time error detection ensuring reliable submission.

Safeguard data with AI-powered fraud detection and SOC 2 Type II compliance to protect privacy.

Orchestrate borrowers to sign documents online, ensuring seamless deal closure and eliminating paper-based hassles.

Collect APIs with cloud storage to seamlessly access scalable data, helping businesses reduce admin tasks and focus on strategy.

Provide a secure platform for borrowers to manage loans and communicate queries with lenders.